BudgetBoss Help Center

Master your finances with our simple, effective budgeting system

Get Started Free →

Why Budgeting Matters

Budgeting isn't about restriction—it's about empowerment. Our system helps you answer two crucial questions:

Am I spending more than I earn?

Identify financial leaks before they become problems with our intuitive tracking system.

How much can I safely spend?

Know exactly what's available for life's pleasures without compromising your financial health.

Step 1: Account for Regular Expenses

Start by capturing all recurring bills and payments:

- Housing (rent/mortgage)

- Utilities (electric, gas, water)

- Insurance payments

- Subscription services

Budget Boss automatically tracks these obligations, so you'll never miss a payment.

Step 2: Manage Discretionary Spending

After accounting for essentials, you'll see your Available Cash for:

- Dining out & entertainment

- Personal purchases

- Gifts and celebrations

- Hobbies and leisure

Tip: Create separate budget categories for different spending types to maintain better control.

Step 3: Build Your Savings

What remains after expenses becomes your savings potential:

Pro Tip: Create separate "savings accounts" within Budget Boss for different goals (emergency fund, vacation, etc.)

Step 4: Maintain Your Balance

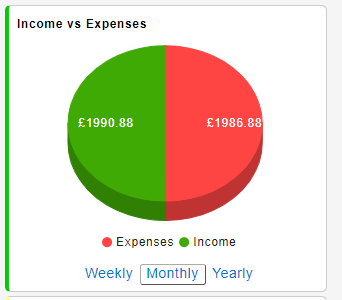

Our visual dashboard clearly shows your income versus expenses:

- Red alerts highlight when spending exceeds earnings

- Green indicators show healthy financial flow

- Customizable reports help track progress

Recommendation: Update your budget weekly for optimal accuracy.

"Financial confidence begins with clarity"